Enter a 100% GST transaction

To create an Invoice for 100% GST, follow these steps...

Go to Sales/Hire > Customer Overview, and select the relevant customer.

Click the + New Invoice button.

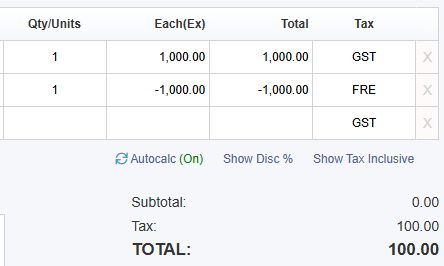

Ensure the Invoice is in Tax Exclusive mode (not Inclusive). If the the Each column is displayed as Each(Ex) then the Invoice is in Exclusive mode. If not, then click the Show Tax Exclusive link located at the bottom-right, just above the Subtotal section.

Add an item to the Invoice as a positive value, with the GST tax code, e.g. 1,000.00

Add the item again on the next line with a negative value and the FRE tax code, e.g. -1,000.00

The Invoice should appear as follows, accounting for 100% GST on 1,000.00 being 100.00 as per the following example.

If you are using the Xero accounting exporter, refer to the Xero help guide for further information:

https://central.xero.com/s/article/Enter-a-100-tax-transaction#Entera100GSTsale